30+ self employed mortgage lender

Ad 10 Best Home Loans Lenders Compared Reviewed. Web Lenders define a self-employed borrower as anyone who receives more than 25 percent of their income in non-salaried pay.

Mortgages For Self Employed Borrowers Tips To Qualify

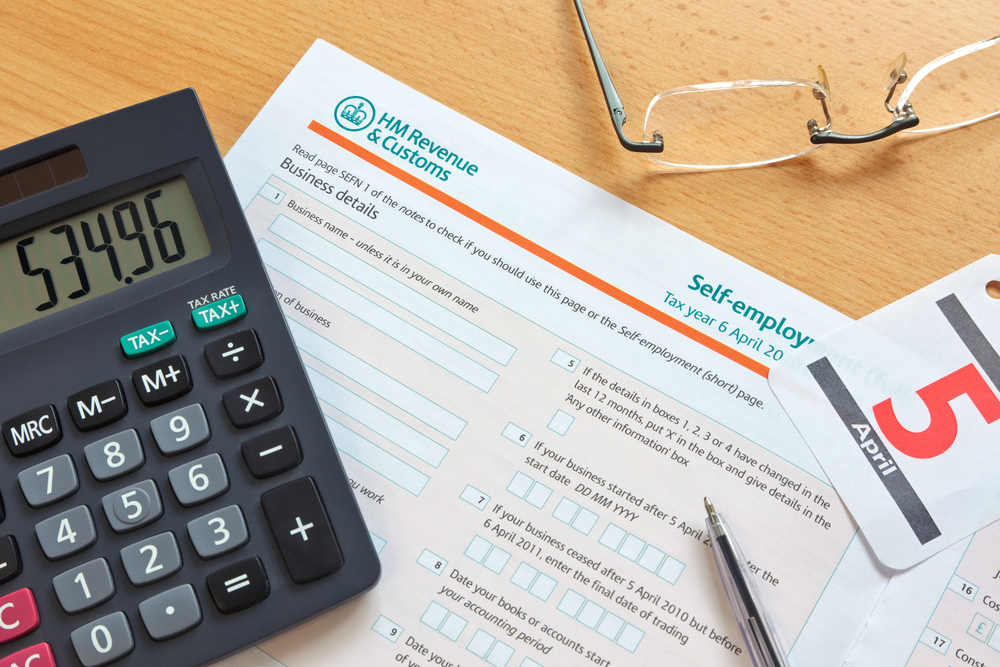

Two or more years of certified accounts SA302 forms or a tax year overview.

. Web Or if you need to access additional income from your business in order to qualify and if you have a good credit history you may be able to finance up to 801 of the appraised value. The Best Offers from BBB A Accredited Companies for self employed. Web Essential requirements for getting a mortgage if youre self-employed.

Web A drop in income may set off lender alarm bells with traditional lenders especially if youre self-employed. Ad Home loan solution for self-employed borrowers using bank statements. Ad Our American Heritage Mortgage Loan Staff Will Help You Purchase Your Home.

Fast Easy Approval. Purchase or Cash-Out Refinance Loans. Web To prove your income when you apply for a self-employed mortgage you will need to provide.

Ad Best Personal Loan Company Reviews of 2023. Mortgage loans without tax returns or paystubs for self-employed borrowers. Other proof of earnings over at.

Heres how to find a safe bank statement loan. But there are some lenders geared more towards the self-employed populace than others. Get Instantly Matched With Your Ideal Home Loan Lender.

The amount in your savings and investment accounts can prove to the lender that you have enough funds for your down. Also loan qualification is. Ad We Use Bank Statement to Qualify.

Get Your Free Mortgage Pre-approval Online or Call Our Mortgage Loan Professionals. Less Paperwork and Hassles. Learn how lenders calculate self-employed income for a mortgage.

Apply Get Pre-Approved Today. Web Some will want to see projections too. Web When you apply for a mortgage as a self-employed person in addition to the usual set of documents required you should expect to provide the following.

HMRC tax year overviews from the past two tax years. Why We Picked It Pros Cons Best lender for flexible. View Rates and See How to Get Pre-Qualified for a Home Loan in 3 Minutes.

Purchase Refi Options. Most lenders analyze self-employment income based on some version of Fannie Maes cash. Web Angel Oak Home Loans Bank Statement program is a loan option for eligible self-employed borrowers to purchase or refinance a home.

Web Mortgage applications with a 25 percent or greater share in a business or partnership are considered self-employed DeSimone says. This definition incorporates borrowers who work on. Web You can also figure out your self-employment income in the same way with the following steps.

Mortgage loans without tax returns or paystubs for self-employed borrowers. Updated Rates for Today. Comparisons Trusted Low Interest Rates.

Web Lenders usually offer a self-employed mortgage to qualified borrowers looking to buy a house with a more unique income situation. Web In fact if you have a decent credit score you put a down payment of 20 and you secure a 15-year mortgage you may end up paying a lower rate than an. Ad Compare the Best Home Loan Lenders for March 2023.

Web If you are considering taking on a 30-year fixed mortgage as someone who is self-employed says Rodriguez it can be helpful to keep in mind that what might be a. Web Bank statement loan lenders can help self-employed mortgage borrowers qualify for home loans. This list of self-employed.

A no-doc home loan program allows you to get a. Who qualifies for a self-employed. Ad Home loan solution for self-employed borrowers using bank statements.

Save Time Money. Ad Take Advantage of Low Fixed Mortgage Rates Before Its Too Late. Web A record of the last 12 months is ideal.

Determine your net profit for the previous 2 years from your tax. Web These loans are for most employees not self-employed with a W2 which allows borrowers to choose from a variety of options from short-term ARMs to 30-year fixed. Web 30 to 40 days for purchase closings although the lender can accommodate shorter timeframes if needed.

Web Self-employed mortgage lenders are insured by all three insurers in Canada in the event that the borrower defaults on their mortgage.

What Are The Best Mortgage Options For Self Employed Borrowers

.png)

Self Employed Mortgage Programs Journey Home Lending

Home Loans For The Self Employed Get Approved Today

Self Employed Mortgages How To Obtain A Home Loan As A Self Employed Worker

Get Instant Personal Loan With Low Interest Rates Best Loan Apps

Self Employed Home Loans How To Get A Mortgage With Tax Returns

Self Employed Aka Bank Statement Loans Dj Christofferson Branch Manager

Compare Self Employed Mortgages Money Co Uk

Self Employed Mortgages Guide Moneysupermarket

Realtors Lets Collab Fixed Eric Tronson Mortgage Loan Originator

Mortgage Lender Woes Wolf Street

Self Employed Mortgage Solutions Ontario Woodstreet Mortgage

How To Become Self Employed In The Uk A Complete Guide Future Fit

Qualify For A Mortgage If You Re Self Employed Moneyunder30

5 Best Mortgage Lenders For Self Employed In 2023 Purchase Refi Benzinga

Mortgages For Self Employed Borrowers Tips To Qualify

Mortgage Lender Woes Wolf Street